Australian resort bought by US firm in billion-dollar deal

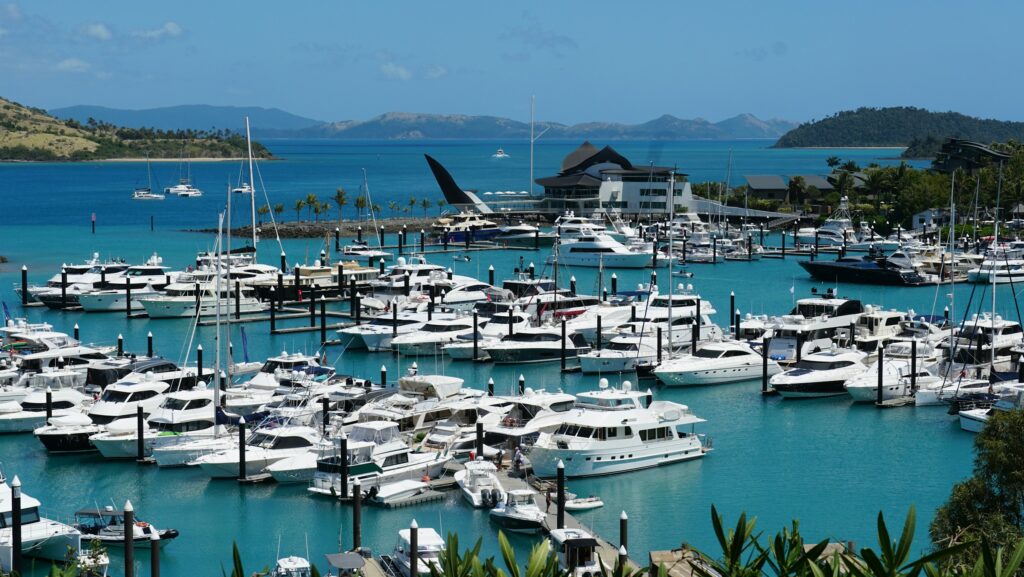

Harbour at Hamilton Island

Harbour at Hamilton Island

US private equity firm Blackstone has agreed to buy Hamilton Island, a popular resort destination in the Whitsunday Islands in Queensland, Australia, from the Oatley family, in a deal said to be worth $1.2bn.

Hamilton Island is located within the Great Barrier Reef, a World Heritage-listed marine area. Blackstone says the island covers more than 2,800 acres across two islands, with around 70 per cent of the land remaining undeveloped.

The resort includes five hotels, more than 20 restaurants and bars, 20 retail outlets, an 18-hole championship golf course on neighbouring Dent Island, a marina and a commercial airport.

The agreement, which is subject to customary regulatory approvals, will expand Blackstone’s existing portfolio of leisure and hospitality assets in the Asia Pacific region, where it has investments across Australia, Japan and India.

Chris Heady, chairman of Asia Pacific and head of real estate Asia at Blackstone, says: “Hamilton Island is an exceptional destination, and we are honoured to build on the vision and dedication that the Oatley family has brought to investing in its transformation and add a standout asset to our portfolio.”

The late Robert Oatley, a sailor and billionaire winemaker, bought the resort for $200m in 2003.

The Oatley family released a statement welcoming the new owners. “Hamilton Island has a special place in the hearts of many Australians. For more than two decades, the family’s passion, led by Bob Oatley, has made significant investments to transform the island into one of Australia’s most loved and visited destinations … we are delighted to have a partner of Blackstone’s calibre and resources to continue the legacy, while supporting our people and island community.”

Hamilton is about 500km south of Cairns and 900km north of Brisbane on Queensland’s tropical coast.

In February 2025, Blackstone purchased US marina giant Safe Harbour for $5.65bn.

In Australia, Blackstone holds investments including Crown Resorts, which operates three entertainment and hospitality resorts in Sydney, Perth and Melbourne, and AirTrunk, a data centre platform operating across the Asia Pacific region.

Globally, Blackstone has investments in hospitality and leisure assets that include an eight-hotel portfolio acquired from Kintetsu Group Holdings in Japan, a joint venture with Panchshil Realty on Ventive Hospitality, which owns and manages hotels in India, the Maldives and Sri Lanka, and Great Wolf Resorts, an owner and operator of family-oriented resort properties in the US.

The company manages more than $1.2tn in assets across strategies including real estate, private equity, credit, infrastructure, life sciences, growth equity, secondaries and hedge funds.

Leave a Reply