Brunswick reports Q4 and full-year 2024 financial results

Brunswick Corporation has reported its financial results for the fourth quarter and full year of 2024.

Brunswick reported a decline in net sales and earnings for both Q4 and full-year 2024, citing lower wholesale orders and reduced production levels. Despite these challenges, the company gained market share in outboard engines and maintained stable performance in key premium segments.

For the full year, net sales were $5.24bn, an 18.2 per cent decrease compared to 2023. Operating earnings on a GAAP basis were $311.6m, a decline of 57.6 per cent, while as-adjusted operating earnings were $495.4m, down 43 per cent. GAAP diluted earnings per share (EPS) from continuing operations were $2.21, representing a 63.9 per cent decrease, while as-adjusted diluted EPS was $4.57, down 48.1 per cent.

Brunswick’s Q4 2024 results show fourth-quarter net sales were $1.15bn, a 15.2 per cent decline from the same period in 2023.

Chief executive officer David Foulkes says: “We had a very solid finish to 2024 characterised by significant cash generation in the fourth quarter, further outboard engine market share gains, successful new product launches and optimal operating performance in the circumstances, all of which enabled us to conclude full-year 2024 slightly ahead of our recent expectations.”

Foulkes notes that U.S. new boat retail sales ended 2024 down by a high single-digit percentage compared to 2023, though Brunswick performed slightly better in key premium segments. Inventory levels across its dealer network stood at 36.8 weeks of supply. The company continued to manage production volumes and field inventory, with early-season boat shows showing positive signs.

Lower production in the propulsion business contributed to a year-on-year decline in fourth-quarter net sales and operating earnings. Despite this, Brunswick gained 110 basis points in U.S. retail outboard engine market share. The engine parts and accessories segment saw a slight decrease in net sales and earnings in the fourth quarter but recorded earnings and operating margin growth for the full year. Navico Group sales remained stable compared to the previous year, supported by new products and performance in the aftermarket segment.

The boat segment delivered results in line with expectations, maintaining inventory levels ahead of 2025. Premium product demand and market share gains contributed to a stable outlook. Freedom Boat Club, which surpassed 600,000 member boating trips in 2024, expanded its operations, adding new locations across the U.S., Europe, Australia, and New Zealand.

At the close of 2024, cash and marketable securities totalled $286.7m, down $193m from the previous year. Net cash provided by operating activities was $449.5m, primarily influenced by lower net earnings.

Looking ahead to 2025, Brunswick anticipates net sales between $5.2bn and $5.6bn and adjusted diluted EPS in the range of $3.50 to $5.00. The company expects U.S. marine industry retail unit sales to remain stable compared to 2024.

Foulkes adds: “2025 has the potential to be a year of steadily easing financial conditions, and while we enter the year with a cautious outlook, particularly for the first quarter, we have already launched many new products across our businesses and we remain extremely focused on delivering steady free cash flow and resilient EPS, and driving continued strong shareholder returns.”

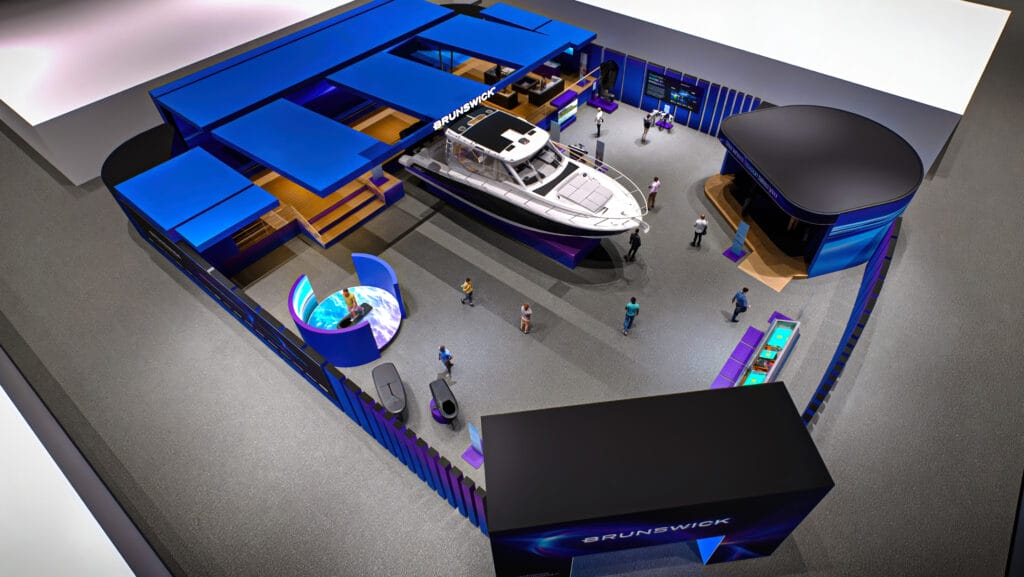

Companies under the Brunswick Corporation umbrella number more than 60 and are split between marine propulsion parts, accessories, distribution, and technology, boats and service, digital and shared-access businesses.

They include Mercury Marine, Mercury Racing, MerCruiser, Lowrance, Simrad, B&G, Mastervolt, Boston Whaler, Lund, Sea Ray, Bayliner, Harris Pontoons, Princecraft, Quicksilver, Freedom Boat Club, Boateka and a range of financing, insurance, and extended warranty businesses.

While focused primarily on the marine industry, Brunswick also leverages its technologies in mobile and industrial applications.