Cummins reports strong third quarter results

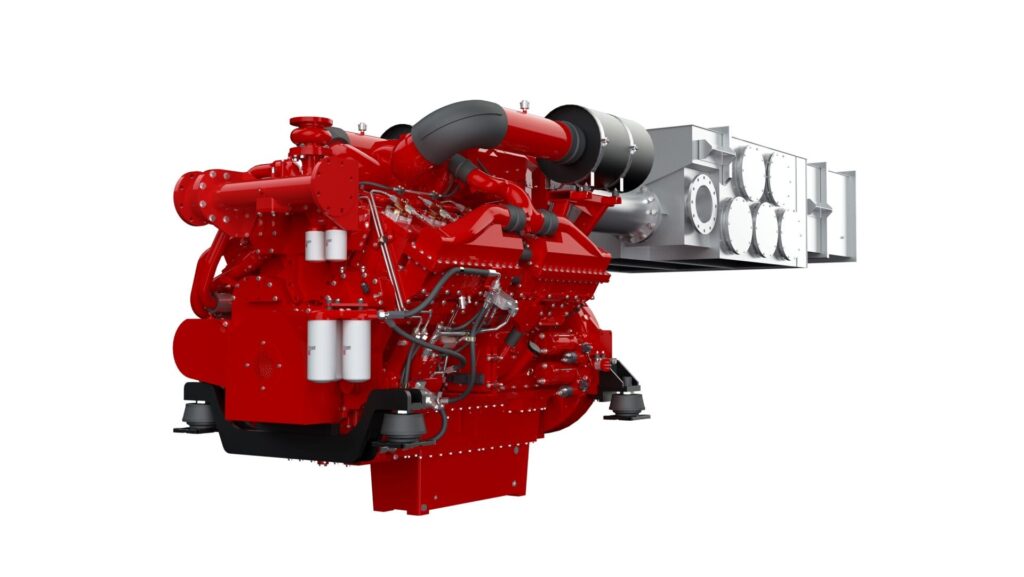

Cummins QSK60.

Cummins QSK60.

Cummins Inc. has released its third-quarter financial results for 2024, reporting steady revenues at $8.5bn, and a net income of $809m. Quarterly North American sales declined by 1 per cent, while international revenues increased by 2 per cent.

Cummins, a US-based producer of marine engines and generators, says it is maintaining its full-year revenue forecast at a range of down 3 per cent to flat, and expects EBITDA to reach approximately 15.5 per cent. The firm reported diluted earnings per share of $5.86, while EBITDA for the quarter reached 16.4 per cent of sales.

“We achieved strong sales and profitability in the third quarter, led by improvement in our power systems and distribution businesses, and have adjusted our full-year projection for EBITDA percentage to be at the top end of the prior range,” says chair and CEO Jennifer Rumsey. “We continue to advance our ‘Destination Zero’ strategy as we deliver innovative technologies for our customers, strengthen our position in key markets, and drive improvement in our financial performance.”

Earnings before interest, taxes, depreciation and amortisation (EBITDA) reached $1.4bn, or 16.4 per cent of sales, up from $1.2bn (14.6 per cent) a year prior. EBITDA in the third quarter of 2023 included costs of $26m related to the separation of Atmus.

Outlook for 2024

Cummins is maintaining its revenue guidance for 2024, with anticipated growth ranging from down 3 per cent to flat, and projects EBITDA of around 15.5 per cent. In a statement, the company says it plans to prioritise cash flow and returns for shareholders, focusing on reinvestment for profitable growth, dividends and debt reduction.

“We solidified our expectations on profitability for 2024 to the top end of our prior range thanks to continued improvements in Power Systems and Distribution segments,” says Rumsey. “Although we faced slowing demand in the North American heavy-duty truck market during the third quarter, Cummins remains well-positioned to deliver strong financial performance, invest in future growth and return cash to shareholders.”

Cummins increased its quarterly dividend from $1.68 to $1.82 per share, marking the 15th consecutive year of dividend increases.

Additionally, Cummins opened a new electrolyser manufacturing plant in Spain through its Accelera business, with an initial production capacity of 500 megawatts per year. Electrolysers, which use electricity to split water into hydrogen and oxygen, are a vital component of the technology needed to produce low-emission hydrogen from renewable or nuclear electricity.

The firm’s components segment reported sales of $2.7bn, down 16 per cent, while the engine segment saw sales dip slightly to $2.9bn. The distribution segment, however, grew to $3.0bn, a 16 per cent increase, driven by strong demand for power generation products and pricing actions.

The power systems segment generated $1.7bn in revenue, up 17 per cent, with the firm reporting “substantial demand” in the data centre sector. Accelera, the company’s clean energy business, reported a 7 per cent increase in sales to $110m, though segment losses continued due to investment in electric powertrain and fuel cell development.

Continue reading about marine business news from the US