NMMA confirms 9% decline in US new boat sales

The National Marine Manufacturers Association (NMMA) — a trade association representing boat, marine engine and accessory manufacturers in North America — has released its Monthly Recreational Boating Industry Data Summary report, highlighting a significant 9.1 per cent decline in new boat sales in North America.

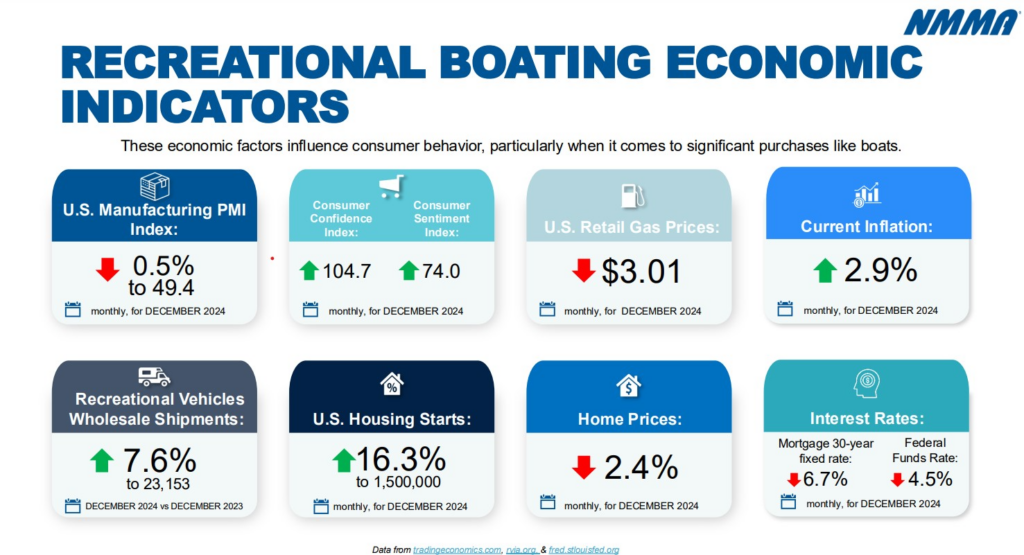

The report analyses recreational boating powerboat unit sales and key economic indicators through December 2024. While these monthly NMMA reports cover a rolling 12-month period, this latest version for December offers a full look at the calendar year 2024, confirming estimates for retail and wholesale sales declines.

NMMA’s US boat industry report 2024

The report — which comes amid news of US President Trump’s sweeping trade tariffs, and the subsequent potential economic and industry impacts — is based on data from NMMA member manufacturers and state governments in partnership with Info-Link. Key findings from the December 2024 report include:

- Declining retail sales: From January to December 2024, new boat retail sales in North America fell by 9.1 per cent, totalling 231,576 units—a significant year-over-year decline influenced by economic pressures and fluctuating consumer confidence.

- Growth in single-family construction: Despite elevated mortgage rates and tight lending standards for construction and development loans, new single-family construction ended 2024 on a strong note. As the new year progresses, the construction industry is seeing an easing in the regulatory environment and tax cuts as tailwinds and tariffs and higher deficits as dampening momentum. NMMA monitors single-family housing starts given their correlations to boat-buying consumers.

- Softening economic indicators: While demand remained in key areas, broader economic indicators affecting the boating industry remained in the “caution” category, signifying concerns over market stability and continued uncertainty.

From the close of 2024 to the first quarter of 2025, economic volatility has had a noticeable impact on consumer sentiment. The Conference Board Consumer Confidence Index declined by 7 points in February to 98.3, marking the largest monthly decline since August 2021. This is the third consecutive monthly decline, bringing the index to the bottom of the range that has prevailed since 2022.

As the recreational boating industry manages lower retail sales, Info-Link Technologies recently reported that as of year-end 2024, the median age of current boat owners in the US is 60, with more boat owners in their 70s than in their 40s. Info-Link’s Jack Ellis notes: “Many of the people who owned boats 25 years ago are the same people who own boats today, but they’re 25 years older.”

Ellen Bradley, NMMA chief brand officer, adds: “The latest economic news, coupled with the median age milestone, reinforce the importance of industry-wide efforts to generate category awareness and excite potential boaters and watersports enthusiasts while retaining existing boaters through Discover Boating and related efforts from Take Me Fishing, especially in down cycles, as this is key to maintaining our momentum and sustaining long-term growth.

Discover Boating, powered by NMMA and Marine Retailers Association of the Americas, has previously utilised the social media platform TikTok in an attempt to engage the next generation of boaters.

“NMMA’s monthly data reports offer a glimpse into market conditions. However, we also need greater visibility into participation and changing consumer behavior as we work to engage next-generation boaters. These are two priorities for Discover Boating in the coming year as we work to boost demand and support members and the larger industry in making informed decisions related to everything from marketing to new product development.”

The White House has announced a series of trade actions under President Trump’s America First Trade Policy that are likely to affect the US boating industry. These actions include reinstating Section 232 tariffs on steel and aluminium imports at 25 per cent each and implementing a 25 per cent tariff on imports from Canada and Mexico.

Additionally, an extra 10 per cent tariff on all imports from China was announced on 26 February, bringing the total tariff on Chinese imports to 20 per cent following a previous 10 per cent increase.