Teledyne acquires FLIR for approx $8billion

Teledyne Technologies Incorporated and FLIR Systems have jointly announced that they have entered into a definitive agreement under which Teledyne will acquire FLIR in a cash and stock transaction valued at approximately $8.0billion.

The deal between sensor giant Teledyne and sensing company FLIR is expected to close sometime in the middle of this year. While both companies make sensors, aimed primarily at industrial and commercial customers, they actually focus on different specialties which Teledyne says makes FLIR’s business complementary to, rather than competitive with, its existing offerings.

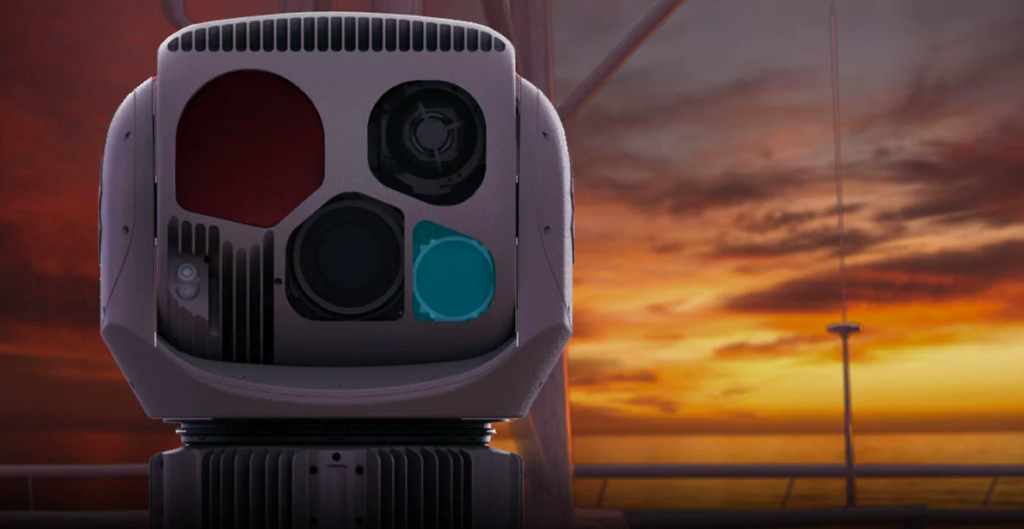

FLIR’s technology is used widely in the marine market.

Teledyne serves aerospace and defence customers, including NASA, as well as healthcare, marine and climate monitoring agencies but FLIR’s products cover some areas not currently addressed by Teledyne, and in more depth.

Under the terms of the agreement, FLIR stockholders will receive $28.00 per share in cash and 0.0718 shares of Teledyne common stock for each FLIR share, which implies a total purchase price of $56.00 per FLIR share.

“At the core of both our companies is proprietary sensor technologies. Our business models are also similar: we each provide sensors, cameras and sensor systems to our customers. However, our technologies and products are uniquely complementary with minimal overlap, having imaging sensors based on different semiconductor technologies for different wavelengths,” says Robert Mehrabian, executive chairman of Teledyne. “For two decades, Teledyne has demonstrated its ability to compound earnings and cash flow consistently and predictably. Together with FLIR and an optimised capital structure, I am confident we shall continue delivering superior returns to our stockholders.”

“FLIR’s commitment to innovation spanning multiple sensing technologies has allowed our company to grow into the multi-billion-dollar company it is today,” says Earl Lewis, chairman of FLIR. “With our new partner’s platform of complementary technologies, we will be able to continue this trajectory, providing our employees, customers and stockholders even more exciting momentum for growth. Our board fully supports this transaction, which delivers immediate value and the opportunity to participate in the upside potential of the combined company.”

FLIR’s SeaFLIR 280-HDEP Maritime Surveillance System is pictured above.