VesselsValue launches Automated Valuation platform for Superyacht

Pictured L-R: Matthew Freeman (Chief Commercial Officer), Dennis Causier (Senior Superyacht Specialist), Sam Tucker (Project Lead) (Image Courtesy: VesselsValue)

Pictured L-R: Matthew Freeman (Chief Commercial Officer), Dennis Causier (Senior Superyacht Specialist), Sam Tucker (Project Lead) (Image Courtesy: VesselsValue)

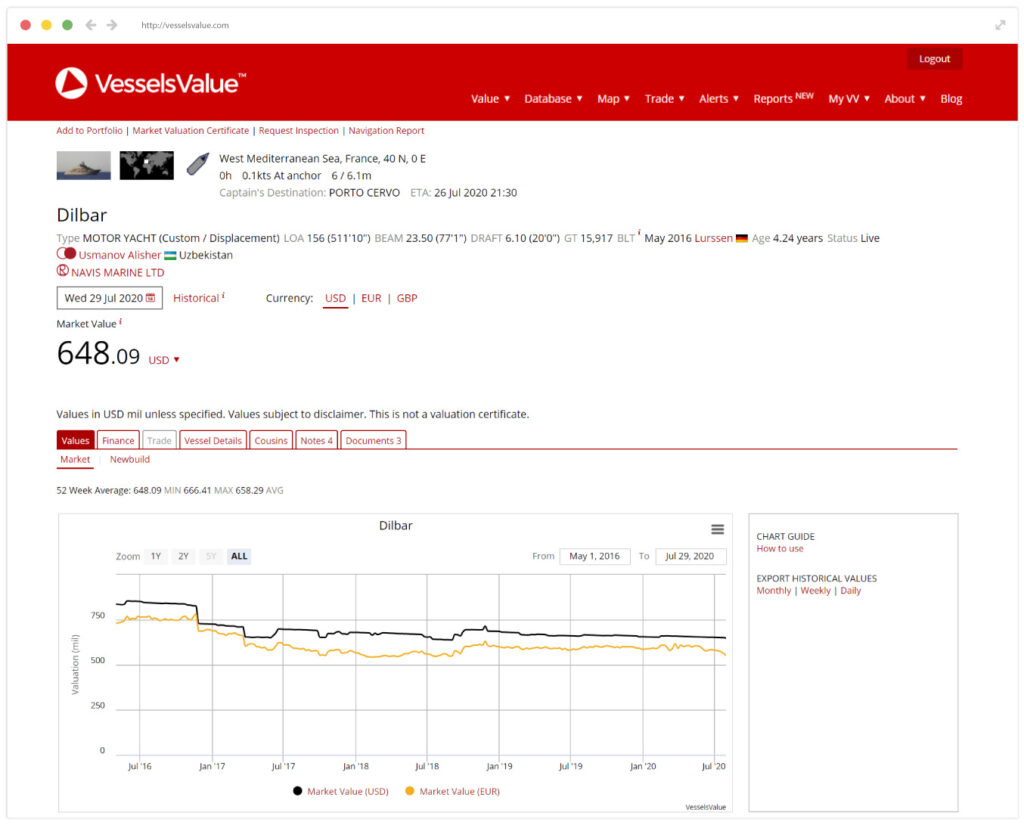

London based online valuation and data provider, VesselsValue Ltd (VV) has launched an automated valuation platform for Superyachts, an industry first, according to seanews.

The company, who already have deep roots in the maritime industry, has gone live with daily updated current and historical values back to 2012, available for over 6,000 superyachts greater than 24m in size.

It’s the first time VV’s product has been available to the wider consumer community as well as existing industry stakeholders. The database that underpins the automated valuations contains over 9,000 live and on order yachts together with a comprehensive searchable record of all asking prices, sale and purchase transactions, newbuilding contracts and refits in an effort to bring true transparency to the market.

“Whilst over 20% of Superyachts are for sale at any given time, sale prices are rarely disclosed to the market place and therefore VesselsValue’s aim is to make the market more transparent and be the number one go to valuation service for Superyachts globally,” says Chief Commercial Officer, Matthew Freeman.

VV’s superyacht division is led by a team of experts including yachting specialist Dennis Causier. According to seanews, Causier has been involved in the industry for over 40 years, both in an advisory role and as a yacht owner himself. He acts as a commercial counterpoint to the data that VV provides.